Key Insights: Ecommerce, omnichannel marketing, CTV, and holiday season conversions

Customer data remains the center of the advertising universe and the key to conversions, how an omnichannel strategy will drive your holiday season sales.

Customer data remains the center of the advertising universe and the key to conversions, how an omnichannel strategy will drive your holiday season sales.

This week we share revenue-driving insights on omnichannel marketing and CTV advertising that can help ecommerce businesses increase consumer trust across marketing channels throughout the holidays and beyond.

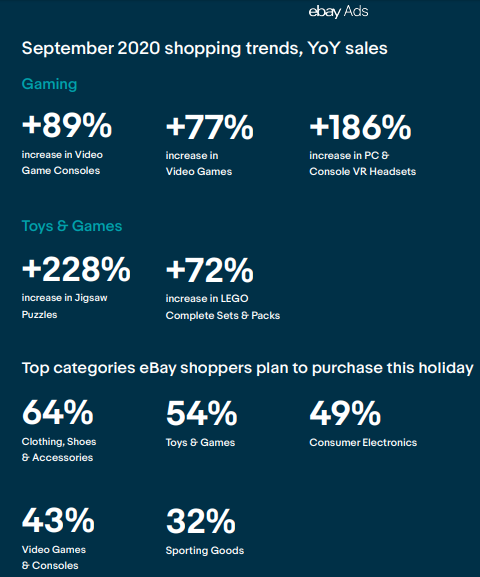

eBay Ads surveyed 2000 eBay shoppers and 2000 online shoppers to uncover the state of ecommerce during the gifting season.

Holiday shopping started earlier than usual and will also stay longer than usual.

An eBay shopper looking to buy a cell phone or smartphone takes 21 days on average to make a purchase.

Here’s a look at some of the holiday season gift categories and how they fare.

Ecommerce Email Marketing and SMS Platform, Omnisend, published its quarterly report, Email, SMS, and Push Marketing Stats & Trends Rep (Q3 2020) that analyzed nine million SMS and push messages sent by 50,000 global merchants. Even though automated consisted of just 2% of email sends they drove nearly 32% of the email marketing conversions in Q3 2020.

Some other key takeaways on omnichannel marketing (Email, SMS, and push notifications):

Ecommerce brands can induce more conversions only if they prioritize communicating at these touch base with their online buyers’ journey milestones. Automated emails need to be prioritized for these stages:

Co-Founder and CEO of Omnisend, Rytis Lauris, emphasized the key role of omnichannel communication,

“The use of SMS and push messages by marketers will increase this holiday season as a growing number of consumers see them as trusted ways to engage with brands,” added Lauris. “Ecommerce businesses must embrace SMS now or risk falling behind.”

Independent advertising and analytics platform built for television, Innovid, revealed some surprising insights in their fall 2020 edition of its U.S. Video Benchmarks Report.

Their findings represent a bird’s eye view of video advertising data:

Contrary to typical trends of video ad spends hitting breaks, CTV viewing grew by leaps and bounds in 2020 winning more attention from advertisers. Despite CTV’s unparalleled growth, mobile devices defended a narrow lead of 2% over CTV, while desktop impressions continue to trend downward.

When analyzing growth by comparing standard and advanced video impressions, mobile growth fared better with advanced (formats that are personalized or interactive) video (+27% YoY), while CTV dominated standard (+56% YoY).

Interactive ads delivered great viewing experiences and had 14x the engagement rate of the next highest ad type.

CDP provider BlueVenn collaborated with London Research found that companies that collated and analyzed customer data grew by 16% in the last year. In fact, they were twice as more likely to exceed business goals and see great ROI.

The Omnichannel Marketing Excellence report is based on a global survey of 235 organizations with annual revenues of at least $50m across the US (42%) and the UK (38%).

Other key findings from their report:

This week, our readers have been looking at the other side of martech, offline customer engagement, and the real metrics for success identification.